Back in 2017 I had a much more dire market forecast because I saw foreclosure starts on the rise and lending practices loosening (which typically leads to more foreclosures). Not to mention the fact that we were 9 years into the typical 7 year real estate cycle, and the higher interest rates (which were supposed to go up in 2017) would certainly soften the market. Well the rates didn’t go up as drastically as economists predicted and the overall demand to live in DFW has caused even more development and further increase in home values across the metroplex. So what’s going to happen this year?

Massive job growth in DFW

We still have 10,000+ people moving to Dallas each month and there is no sign of a slow down. Dallas is home to over twenty Fortune 500 Companies including Toyota, Exxon, AT&T, American Airlines, Southwest Airlines, Kimberly-Clark, Texas Instruments, GameStop, and Dr. Pepper Snapple Group. All of these companies are experiencing healthy growth and are hiring talent from all over the country. Now add to that all the companies that are relocating to DFW.

Steady growth and then stabilization in 2020

I predict a steady growth of the real estate market over the next two years and stabilization in 2020 once the interest rates have settled around 5.5%. It won’t be anything like the growth we saw in 2014 and 2015. It will likely be around 5% growth in the low-end of the market, 3% growth in the mid-end of the market, and 2% growth in the high end of the market. Every area of Dallas has it’s low, mid, and high price points depending on where you are. If you’re in Highland Park, the low-end is $800k-$1.4M, mid-end is $1.4M – $2.5M, and high end is $2.5M+. If you’re in Frisco, the low-end is $150k – $275k, the mid-end is $275k – $500k, the high-end is $500k+

Inventory Remains Low

Housing inventory is still very low but new construction is helping to offset this deficit. New construction makes up about 27% of the inventory in the market which should slow the increase of prices across DFW. This is especially apparent in areas where resales are directly competing with new construction, and have to decrease their prices to be more competitive.

Interest Rates Poised to Increase

Experts predict interest rates to go up as high as 4.75% in 2018 and then settle at 4.5% by the end of the year. With this, you never know if they are going to go up, but what we do know is that higher interest rates reduce buying power, which in turn softens the market. For every 1% increase in interest rate, buying power drops by 10%. So if you were qualified to purchase a $500k home, you are now only qualified to purchase a $450k home. Pretty significant.

Still a Good Time to Invest in Real Estate

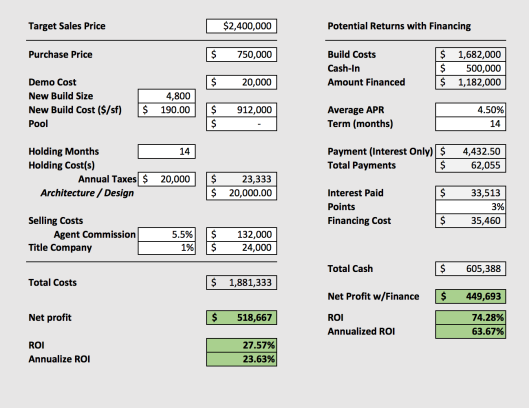

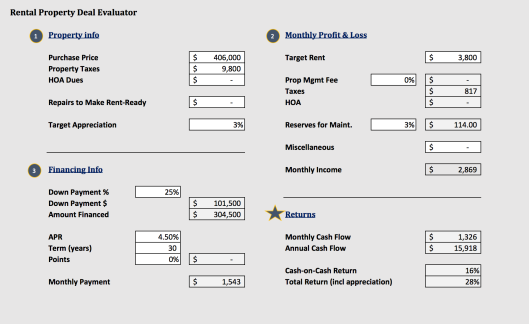

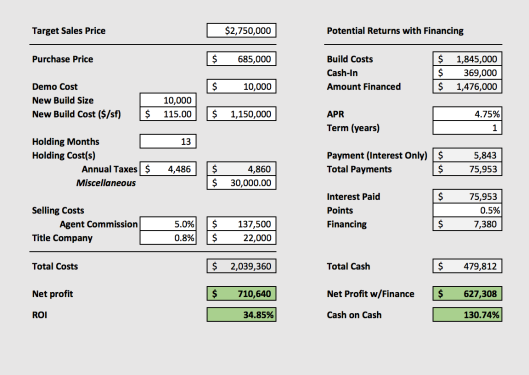

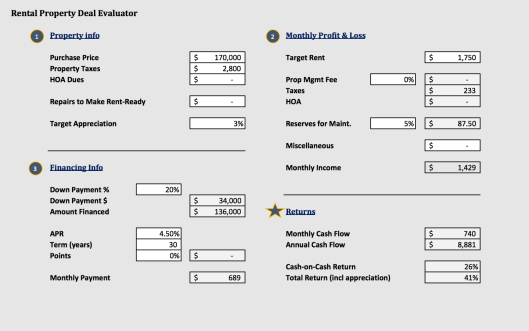

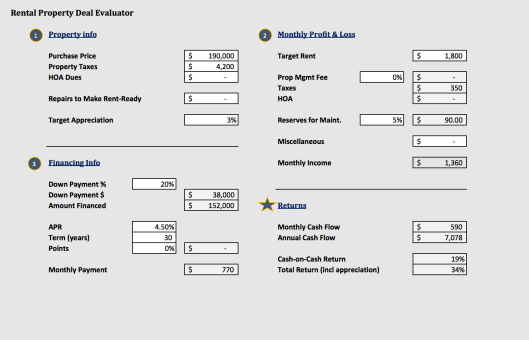

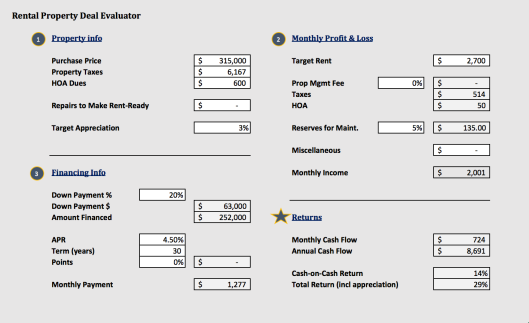

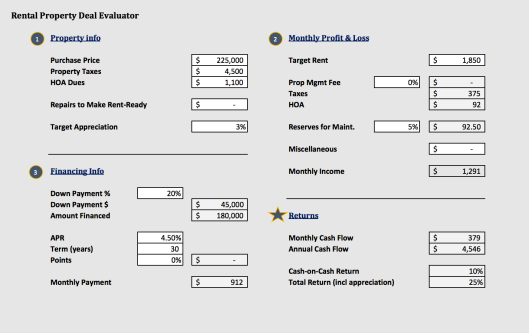

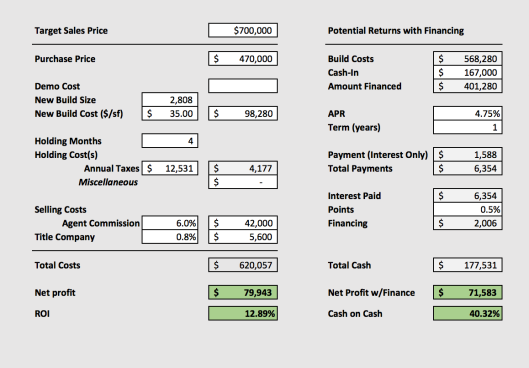

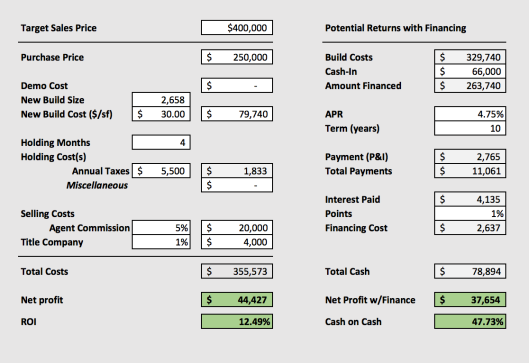

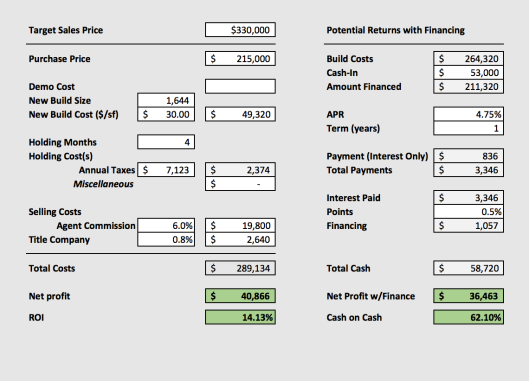

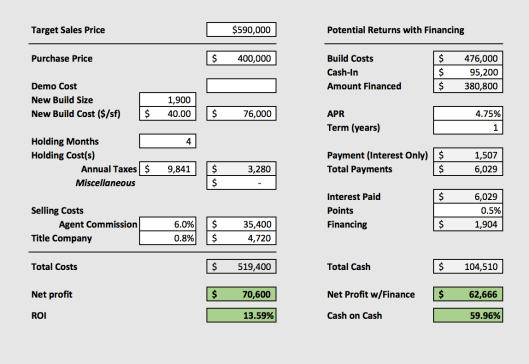

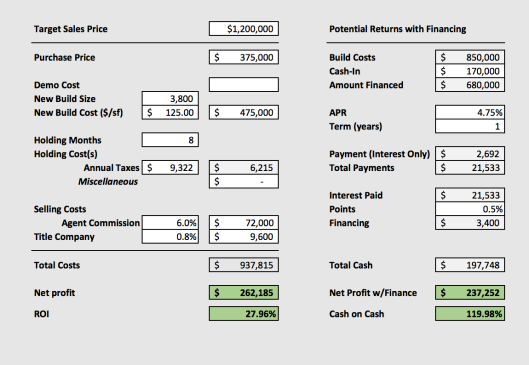

If you want to flip houses, this may not be the best time for that. There are hundreds of avenues in the real estate investment world, and flipping houses is just one of them, albeit the most popular one. You have to invest where the demand is, and what my investors and I found to offer the highest returns is in single-family new development in the $1M to $2.5M range, value-add commercial projects, and commercial new development. I think the biggest reason for this is because these opportunities are not as blatantly obvious as flips, which is also why flips are not very profitable these days (everyone is going after rehab projects and overpaying). Rentals are not a bad option either, just make sure you’re cash flowing if you’re going to carry a mortgage.

At the moment I’ve got numerous projects on the ground, and I’m always looking for investors to partner with. I’m happy to vet your projects and give you my feedback as well. My team and I are always happy to help 🙂