I work with hundreds of investors and I get the same request: “I’m looking for some off-market deals!” Why? Well, off-market deals are typically selling for 10% less than if they were listed on the MLS. That is if you’re dealing directly with the seller. If not, then you’re most likely dealing with a wholesaler or that seller’s representative. Either way, you’re going to have to pay a finders fee.

What does a fair deal from a wholesaler look like?

I’m a firm believer that if you are working hard and providing value, you should get paid for it. For this reason I believe wholesalers deserve to collect a fee in proportion to the value they are bringing to an investor. Let’s quantify what this fee should be. If someone brings me a deal that could sell for $350k on MLS, I would expect to pay at least 5% below that: $332,500. Reason being, we don’t really know for sure what it will sell for on MLS, and there are typically some additional closing costs when not buying on MLS. The fee collected should be the difference between their purchase price and 95% of MLS value. Granted, this is a fair deal, not a great deal. Great deals are those purchased 10% below MLS, even after a fee has been paid. Don’t expect to get a deal like that from a wholesaler. There’s no reason for them to leave that much meat on the bone when investors will happily pay 95% of MLS. If you’re not sure what the MLS value of a property is, consult a Realtor that’s familiar with the area you’re buying in.

What to watch out for…

Wholesaling real estate can be very lucrative, and even more so for those wholesalers that employ less than ethical practices. Here are some things to watch out for:

- Auction style bidding – “Bring your highest and best bid.” This is a way for the wholesaler to make more money on their growing network of investors. The seller doesn’t see a penny of this additional money.

- Under estimating repairs – As a “service” to their investors, some wholesalers offer packaged deals with repairs already calculated. Even when they have a GC (general contractor) run the numbers, they are typically half of what it will really cost to achieve the ARV (after rehab value) they are pitching.

- Overestimating ARV – It’s not uncommon for a wholesaler to cherry pick the best comps, including those with much more desirable lots, better floor plans, very high end updates, gorgeous backyards, etc. When estimating an accurate ARV, it’s best to get an experienced Realtor involved.

- Hidden closing costs – Make sure that the wholesale discloses ALL costs associated with the transaction. The best way to do this is to ask for the title company to prepare a preliminary HUD prior to signing the contract.

- Selling for above MLS value – This sounds silly right? I mean who would pay above market from a wholesaler? Well many of the listings that wholesalers are slinging come directly from MLS! They get them under contract and then offer them to you at a $10k+ markup.

MLS vs. Wholesale

Investors tend to shy away from on-market (MLS) opportunities, since they believe the exposure will create too much demand and they will not be able to buy at a price that will result in a desirable profit. Well this is true, most of the time. However, there are underrepresented and overpriced listings out there that are practically invisible to most. Most of my flips are purchased on MLS. Sometimes I pay list, sometimes much less. It all depends. I don’t offer what it’s listed for, I offer the amount that makes sense to make the deal work.

Buying wholesale on the other hand is operated on a first come first serve basis. Here’s the price, if it makes sense for you, it’s yours. Here are some of the major differences over buying on MLS:

- Cash or hard-money only

- Must close quickly – In most cases 2 weeks or less.

- Little to no room for negotiation

- No inspection period – you typically have to do all your inspections the day you see the property.

- Additional closing cost – When buying on MLS, the seller typically pays for the title policy. When buying from a wholesaler, you pay for the title policy as well as the wholesalers title policy, which together, is about 1% of the purchase price.

I know, buying wholesale doesn’t sound that great anymore. But it can be! You just need to find a wholesaler that’s not greedy and does a good job of identifying lucrative opportunities. A good wholesaler contact is worth their weight in gold.

If you’re a great wholesaler, I’d love to hear from you. If you would like me to verify any of the deals your wholesaler is sending you, I’d be happy to help. Good luck out there!

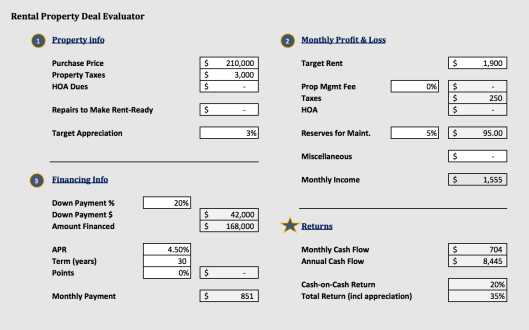

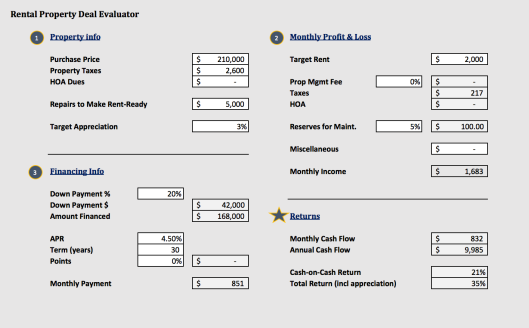

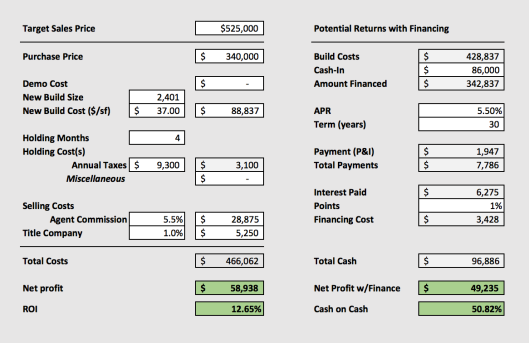

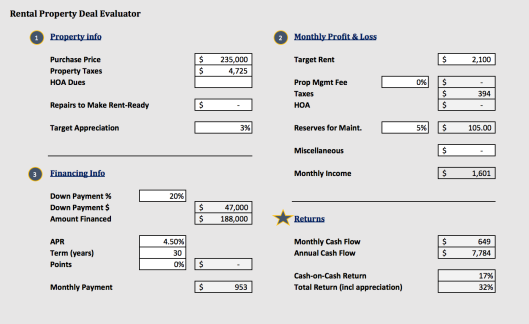

Lot 1 – 49×151

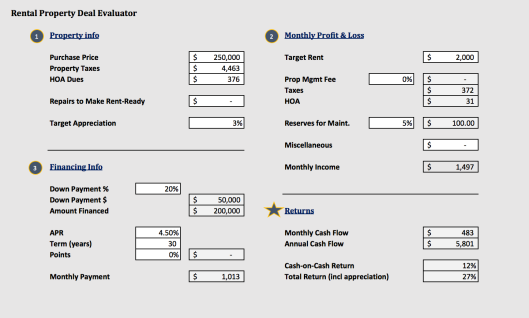

Lot 1 – 49×151